Content Reviewed by:

Dave Gormley •

November.10.2019

Vertified Content

Nov 10, 2019

| Read Time: 9 minutes

Article Contents

Requesting Foreclosure Mediation in Maryland

When someone comes into our Waldorf or Lexington Park offices for a foreclosure consult, they often have a packet from their mortgage company that includes the Maryland Foreclosure Mediation Op-In Form. Many people ask if going to mediation is worth the $50 fee.

The answer is it may be worth doing, but it probably won’t stop the foreclosure.

There is always the chance the mortgage company may agree to give you a repayment plan or loan modification. I just think the odds of them doing this are pretty slim.

However, the mediation process can help – even if you don’t end up getting to keep your house.

During the mediation the mortgage company will be asked to explain what loss mitigation programs they have. These programs may give you options to short sale, rent back or get keys for cash.

For more on these options and the foreclosure process see our guide What You Need to Know About Foreclosures in Maryland.

What is Foreclosure Mediation?

Mediation is a meeting where a neutral party tries to help two parties reach an agreement.

The mediator is not going to decide who is right or who is wrong. They cannot order the mortgage company to let you keep your house. Mediation just give the parties a chance to resolve any their issues by agreement.

When a mortgage company wants to foreclose on your house, they have to send you information to request mediation. This usually happens when the mortgage company sends a Notice of Intent to Foreclose. This is contained in a thick intimidating packet of information.

I imagine many home owners miss the request for mediation. They see the word “foreclosure” and figure it’s time to give up, and they put the packet in the recycle bin.

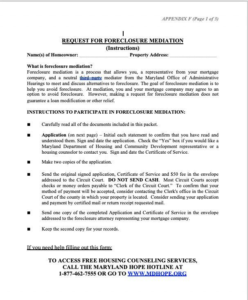

To take advantage of the mediation you have to request it. Some States require mediation unless the homeowner opts out of it. Maryland makes you opt in.

Therefore if you don’t file the request with the fee, or a request for a fee waiver the mortgage company can skip this step.

The Process of Foreclosure Mediation

First you fill in the request and send it in with the $50 you will get a notice of the date and time for the mediation.

Next the Maryland Office of Administrative Hearings will send you the notice of the date and time of the meeting. An administrative law judge will be assigned as the mediator.

Remember, they are acting as a mediator. They want to help you and the mortgage company reach an agreement. However they are not acting as a real Judge who can decide who wins or loses a case.

Most of the mediation locations take place at one of the County Circuit Courts.

But this will not necessarily be the Circuit Court for the County where you live. For more on the foreclosure process see the State of Maryland’s Summary of the Foreclosure Process and their Maryland Foreclosure Timeline.

At the mediation the mortgage company will usually have a lawyer present with a representative from the mortgage company available on the phone. The representative will often be asked to list the programs they have for loan modification or loss mitigation. They will explain what it takes to qualify for these programs. They may explain why the homeowner doesn’t qualify for these programs.

In Southern Maryland the foreclosure mediations usually get scheduled in the Prince George’s or Calvert County Courthouses. I think these locations often leave the homeowner feeling like they are attending a hearing. I’ve had homeowners say the Judge ruled against me and said they can foreclose on my house.

You can find a list of the location at Office of Admirative Hearings Foreclosure Mediation Page. For some more details on the process see the Civil Justice Resource Page.

Why Won’t the Mortgage Company Work with Me?

Now keep in mind that a lot of people come to see our firm after they have gone to mediation. Needless to say, these are people who didn’t have a successful mediation. They are now looking to file for bankruptcy.

Maybe there are a lot of people who have success at mediation? We just don’t see them.

When someone comes to us after a failed mediation, we try to explain why it may have not succeeded. These are usually things the homeowner can’t do anything about.

First, it’s not about you. It is the mortgage company. They have a business model. They have their systems. And they have their statistics.

The Business Model

The business model of the mortgage industry has changed. The product is your loan. Or, more accurately, a package of loans that are bought and sold by banks and investors. This is why your loan keeps getting transferred to different mortgage companies and lending services.

The lender didn’t buy your loan, they bought a package of loans. These are often traded as mortgage backed securities.

There are investors that look to buy high risk loans. They buy these packages cheap knowing the will loose on some and collect on others. Sometimes the business is to find enough homeowners with high interest rates that they can give loan modifications and still make money. But sometimes the model is to be good at foreclosures.

Then their business model is to just foreclose as quick as they can.

If a bunch of loans at twenty cents on the dollar and they can auction them at foreclosure at fifty cents on the dollar they have made their profit. The faster they foreclose the more they may make.

The problem is you have no way of knowing their business model. When you apply for a loan modification you have to disclose your finances. But this is like a game of cards where you show your cards and the dealer doesn’t.

The only way to find out if they really will give you a loan modification is to play out the game. If they don’t give you a modification it may be that they never really planned on doing one.

The Foreclosure System

The mortgage company has to inform you of your right to mediation when they start the foreclosure. They can offer it earlier, but most just wait till they start the foreclosure process. By this time, they have already decided they just want to foreclose. Once they head down this path, they aren’t likely to change course.

I often wonder if the representative from the mortgage company is told they have to go to the mediation, but they shouldn’t agree to anything.

If you are looking to get a loan modification to save your house you may want consider filing a Chapter 13 bankruptcy. This will stop the foreclosure, allow you to start making your mortgage payment, and put you on a payment plan to cure the arrears.

While you are in the bankruptcy the lender will probably be more likely to consider giving you a loan modification. Or, you can use a Chapter 13 to buy time to sell your house.

For more on this and other bankruptcy options see our guide on the What are the Different Types of Bankruptcy.

The Statistics

The mortgage company and investors probably aren’t looking at you as an individual. They are looking at you as a statistic.

Part of this goes back to the way they package and buy and sell mortgages. Remember the term mortgage backed securities? If your loan was sold as part of package of high-risk loans the mortgage company expects a high rate of default. They don’t need you to pay them back. These companies just need to make enough money off the loans they bought in that package to turn a profit.

These mortgage companies know they will have defaults and foreclosures. It is part of their business model. Some loans will fail. Some homeowners will file for bankruptcy. But some will make the payments. If they bought those loans cheap enough then they don’t need everyone to make their payments.

They may look at a group of loans and decide not to modify any of the loans. Their statistics may show a percentage will go to foreclosure and a certain percentage will make their payments. In this situation they may even make a loan modification that won’t work for you. But they don’t care about you. They are just looking at what percentage will be able to make that work.

How Do I Make the Most of the Foreclosure Mediation Process?

Make sure you have a plan.The mortgage company has a plan. The problem is they won’t tell you what it is. To find out what they are willing to do you need to have a plan.

Or, more accurately multiple plans. Explore what all your options may be. Then come up with what you need to ask them to do. It also helps the mediator find out what the mortgage company is willing to do if you come in with a specific proposal.

The option the mortgage company is most likely to agree to a repayment plan. This would be short period where you pay them back the amount you are behind plus any foreclosure fees and the regular payment.

This, of course, is the least likely option that is going to work for you. But if you want to discuss this option it is best to tell them how soon you can make a mortgage payment and how much extra you can pay on the arrears.

The next option would be to ask them to modify your mortgage. This is where you ask them to take everything you owe and put into a new loan. But again, you want to propose something specific. It is better to ask if they will modify your mortgage payment to $1,900 a month instead of just saying “I want to save my house.”

Plan for the Worse

But you also need to also plan for the worse. Have a plan for what you will ask them to do if they aren’t interested in letting you keep your house.

Here are some examples of things you may ask them to do. Keep in mind you can ask for any amount of time. However, the shorter the time frame ask for, the more likely they are to agree to it.

What you should ask for depends on what you need. For example are you hoping to stay in the house until school is out? Do you have a place to rent, but it won’t be available for 3 months?

Here are some things you might want to consider?

- Will you hold off on the foreclosure 6 months to let me try to sell my house?

- May I stay in the house for 3 months if I agree to sign the house over voluntarily?

- If I agree to move out in 90 days will you give me money to help with moving?

- May I rent back my house for 9 months?

The more you prepare the more likely it is that you will get something out of the mediation. This also makes you prepared to make a decision about any offer the mortgage company may make. If you are only thinking about saving your house, it is hard to make a decision on the spot about letting it go. This is even more difficult if they start talking about a deed in lieu, short sale and keys for cash if you haven’t done your research.

Do I Need a Lawyer?

That is the easy question. You are going to deal with a lawyer from the mortgage company and a mediator who is an Administrative Law Judge. Your will have to make difficult legal decisions on the spot. Making good decisions when dealing with emotions running high is even more difficult.

If nothing else having a lawyer who can give you advice with some detachment can help.

Does it Make Sense to Hire a Lawyer?

The real question is does hiring a lawyer make financial sense? For example, that money you pay the lawyer, may be the money you need to start paying your mortgage if the mortgage company does offer a payment plan.

Or it may be the money you need to move and for the security deposit on a place to rent. Finally you may need that money so you can try to save your house in a Chapter 13 bankruptcy. To some degree the mortgage company is either going to work with you or they aren’t.

While having a lawyer with you may help with the negotiating, it may not change much what the mortgage company will agree to do in some situations. Therefore you should make sure you factor this in to your decision.

You may even want to see what programs you may be able to get assistance from with representation. The Maryland Department of Licensing’s Resources for Homeowner’s Facing Foreclosure is good place to start. While these programs are worth looking into, they can be hard to qualify for.

Contact a Lawyer for Foreclosure Mediation

Whether you decide to hire a lawyer or not, it is important to understand what mediation is and what you can hope to accomplish.

This why we offer a consultation. We will review all your options and help you come up with a strategy for the mediation. Next we will also look at how bankruptcy can help you save your house or keep the mortgage company coming after you if they do auction your house.

Want to know more? Discover what you need to know about foreclosure and bankruptcy in Maryland. Click here for our Free Legal Consumer Guide What You Need to Know About Foreclosures in Maryland. Click here to see our Free Legal Consumer Guide to Maryland bankruptcy cases and get answers to your questions today.

Know your options. Be informed. Protect yourself.

Need a bankruptcy lawyer? Please contact us for a consultation today if you need a Maryland bankruptcy lawyer for your bankruptcy case.

Like our blog? Subscribe to our email newsletter and stay informed!