Content Reviewed by: Dave Gormley •

March.3.2019 Vertified Content

Mar 3, 2019 | Read Time: 3 minutes

Some people count on their tax refund to pay for their summer vacation or swimming pool membership.

However, many others count on their refund to help them get caught up on their credit cards and other bills.

When you file for bankruptcy you have to count as an asset the tax refund that you are anticipating. So I see this issue a lot.

And I’m finding that the people in Southern Maryland who I represent in bankruptcy are getting smaller refunds than they expected.

If you are finding yourself even further behind because you aren’t getting the refund you expected, or worse because now you owe taxes, come in for a free bankruptcy consultation.

First off, if you are counting on that refund to get caught up on your bills, you may need to think about filing for bankruptcy.

If your tax refund is just getting you caught up on your payments, and not putting a dent in how much you owe, then you probably are just delaying the day that you can’t keep up with your bills. You don’t want to come in for a bankruptcy consult in August wishing you still had that tax refund money to pay us to get started on your case.

While that sounds self serving, almost everyone who files for bankruptcy regrets they didn’t do it sooner. See our guide Trying to Avoid Bankruptcy? 5 Big Mistakes You Could Be Making for tips on other things you will regret trying if you end up having to file for bankruptcy.

Plan on Next Year’s Tax Refund

Regardless of whether you owed, or got a refund, think about adjusting your payroll withholdings. With the new tax laws and tax withholding rules you probably aren’t getting the same refund as you got last year.

Now that you know how these new laws and rules have impacted your refund take some action.

Tax time is a good time for you to do a review of your legal and financial affairs. For tips on how to do a review see our guide How To Do An Annual Legal Review. One of the first things to do is to look at your tax return and seeing if you need to adjust your tax withholdings.

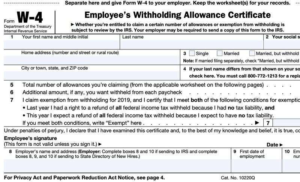

Adjusting Your Tax Withholdings

To adjust your withholdings, you need to amend your W-4. This is the form that tells your employer what to take out of your paycheck for taxes.

This form can be confusing. On top of that the terms can be confusing. To have more money taken out of your paycheck you decrease your withholding exemptions. To have less taken out of your pay you increase your withholding exemptions. So, claiming zero exemptions means you will have more taken out of your paycheck than if you claim five exemptions.

Need help? The IRS has a Withholding Calculator Tool on their website.

You can also just choose an extra dollar amount to withhold. If you owed $2,000, you could tell your employer to take an extra $39 each week out of your paycheck and you should be covered next year. (2,000 divided by 52 weeks equals $38.46).

Or if you have someone prepare your taxes, just ask them to help you complete an amended W-4 to give your employer.

Next Steps

Want to know more? Discover what you need to know about bankruptcy in Maryland. Click here to see our Free Legal Consumer Guide to Maryland bankruptcy cases and get answers to your questions today. Know your options. Be informed. Protect yourself.

Need a bankruptcy lawyer? Please contact us for a consultation today if you need a Maryland bankruptcy lawyer for your bankruptcy case.

Like our blog? Subscribe to our email newsletter and stay informed!